Rules for Claiming Mileage

You may claim reimbursement for mileage up to a maximum of $1716 per school year. Mileage to all approved classes including extracurricular activities is its own 25% category, separate from the 25% allotted max for Extracurricular programs and field trip fees and costs but mileage to a FIELD TRIP goes in with the EC and Field trip 25% not with other mileage.

Mileage can ONLY be claimed for travel within the state of Arkansas. Travel outside of the state even to an approved coop or class is not permissible.

When recording mileage, please track a month at a time before reimbursement. Processing weekly mileage for families will overburden the ADE office very unnecessarily.

1. Always fill in every field.

2. Remember to track to the location and home only once per trip. Meaning the student MUST be in the vehicle for the trip to count. If you drop off at the co-op or a class and go home then return you can ONLY claim the initial dropoff and the drive home after pickup. The child MUST be in the vehicle to claim the mileage.

3. On the spreadsheets you will need to enter the drop off and the pickup as two separate entries. This will give you the milage for the full trip.

4. Trips that can be claimed include travel to a co-op, school, microschool, extra-curricular class and activities, tutoring, and EFA covered therapy. At this time per the law travel can be claimed ONLY to approved vendors and providers, So field trip travel can ONLY be claimed if the field trip is to a location that is signed up as a vendor with the ADE. This rule applies to all locations, but locations can be listed as reimbursement only and not be setup as an active vendor and still fall within this rule. This includes travel to Speech, Occupational, Vision and other educationally needed therapies as long as they setup as a reimbursement only location with the ADE office.

5. Create separate logs for each child BUT each trip can ONLY be claimed on ONE child’s log even if multiple children go.

6. If taking a CAB or TAXI or UBER or LIFT to an approved vendor for services or classes, you may claim 52 cents per mile UP TO the cost on the receipt but NOT OVER.

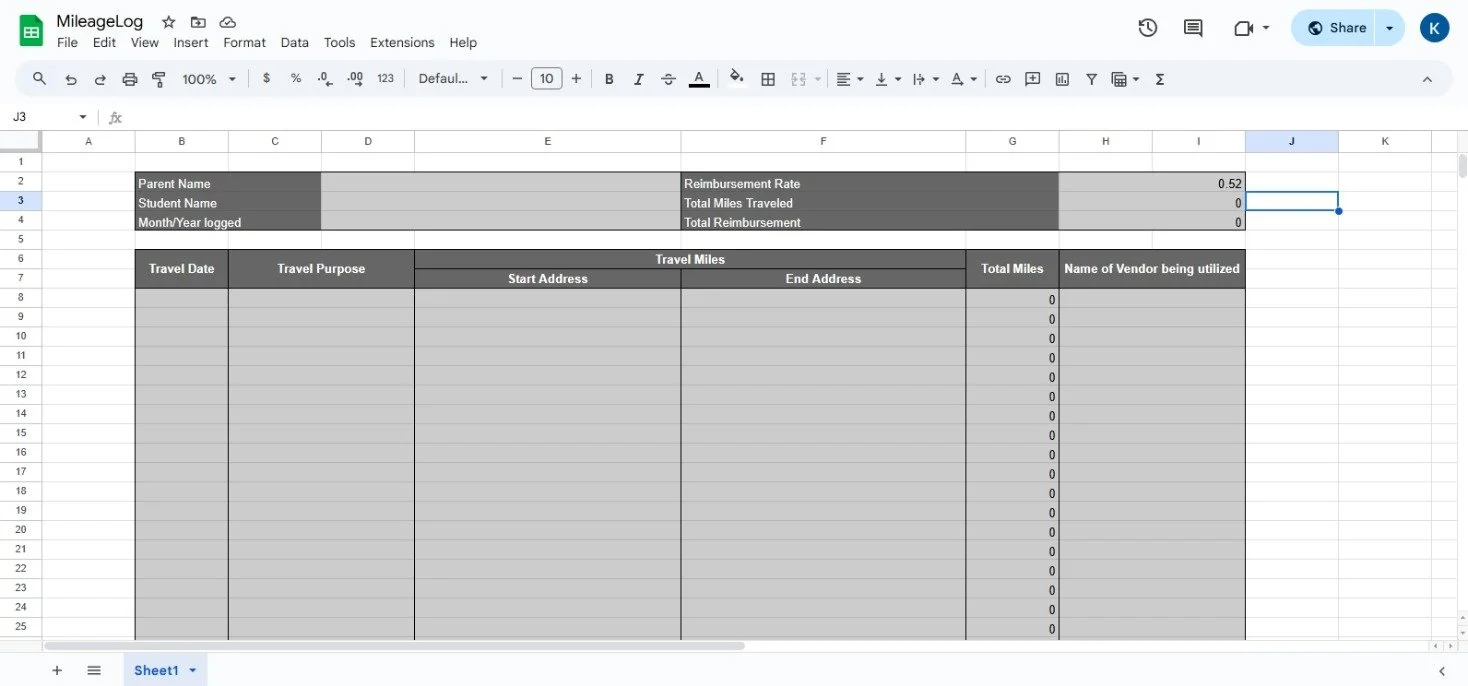

Excel Spreadsheet

This has all the needed data and is quite easy to fill out. Less cute but needs no internet access on the PC to work with it, and works offline using Excel just fine. The downside is you MUST have Excel.

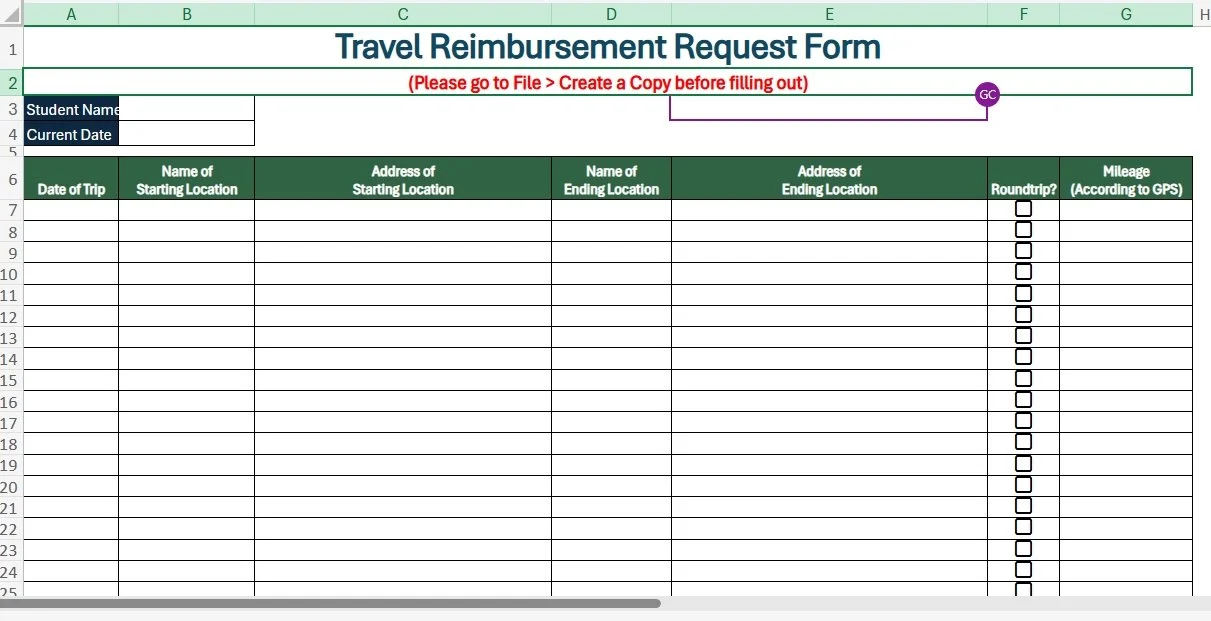

Google Spreadsheet

This is fairly simple to use, but when you click the link, it will tell you cannot edit. You will need to make a copy before you can edit. On the iPhone, I know it asks you to download Google Sheets to edit, but that is a free app. Remember to COPY the document and then edit your copy. This Document allows you to either claim each trip a one way OR simply click ROUND TRIP if you want the mileage you entered to be doubled for you. Clicking the box also alerts the auditor checking that it is in fact a round trip and that is why the mileage is doubled. THE ONLY place you will type milage in the box for per trip miles. If you want it to figure round trip, click that box, if doing each trip separate and not round then do not check the box..

ADE provided Sheet for ROUND TRIP

You will need to go to file and make a copy then open the copy and enable editing. Then you can edit the form as needed. You will need to double the milage yourself to show correct milage the round trip box just lets the EFA know you were accounting for both directions.